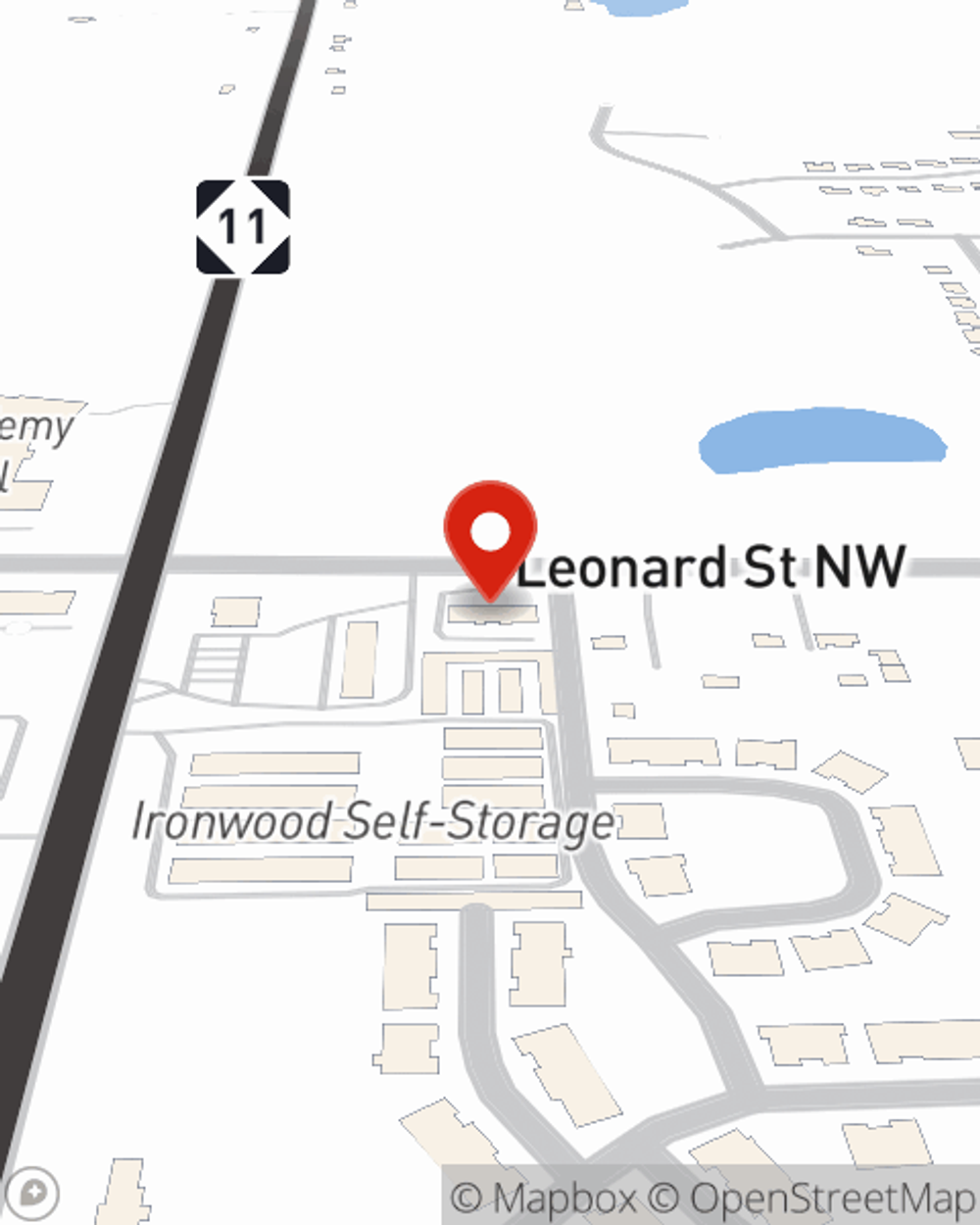

Business Insurance in and around Grand Rapids

Looking for small business insurance coverage?

Insure your business, intentionally

- Grand Rapids

- Standale

- Wyoming

- Grandville

- Jenision

- Marne

- Coopersville

- Sparta

- Walker

- Comstock Park

- East Grand Rapids

- ada

- rockford

- cascade

- forest hills

- spring lake

- grand haven

- allendale

- hudsonville

Cost Effective Insurance For Your Business.

When experiencing the highs and lows of small business ownership, let State Farm do what they do well and help provide quality insurance for your business. Your policy can include options such as extra liability coverage, a surety or fidelity bond, and worker's compensation for your employees.

Looking for small business insurance coverage?

Insure your business, intentionally

Protect Your Business With State Farm

Your company is unique. It's where you earn a living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a facility or earning a paycheck. Your business is an extension of yourself. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers a wide range of occupations like a locksmith. State Farm agent Chad Kerr is ready to help review coverages that fit your business needs. Whether you are a landlord, a dentist or an acupuncturist, or your business is a pet store, a pottery shop or a dry cleaner. Whatever your do, your State Farm agent can help because our agents are business owners too! Chad Kerr understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Get right down to business by getting in touch with agent Chad Kerr's team to review your options.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Chad Kerr

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.